FP&A 2.0 is already happening. From the impact of this year’s pandemic to the continued focus on digital transformation, teams are locking in their processes to work toward future-proofing their organization.

In this video round-up, we bring you a group of videos that feature FP&A insights and best practices. What does the new normal mean for FP&A (Financial Planning and Analysis)? What are the three pillars of FP&A success—and which pillar is most important? And with all of the pivots happening this year, is a rolling forecast or traditional budget the right move? Watch the videos below to find out.

Stay on top of Microsoft Power Platform features, best practices, and techniques by subscribing to the Collectiv YouTube channel.

What is the New Normal for FP&A?

The new normal is impacting the world, but what does it mean for FP&A teams? Chris Ortega offers his insights to help teams working in Financial Planning and Analysis navigate the new normal now…and into the future.

The Value of FP&A (Financial Planning and Analysis)

Chris Ortega explains the value of FP&A (Financial Planning and Analysis) by covering three key areas: people, process, and technology.

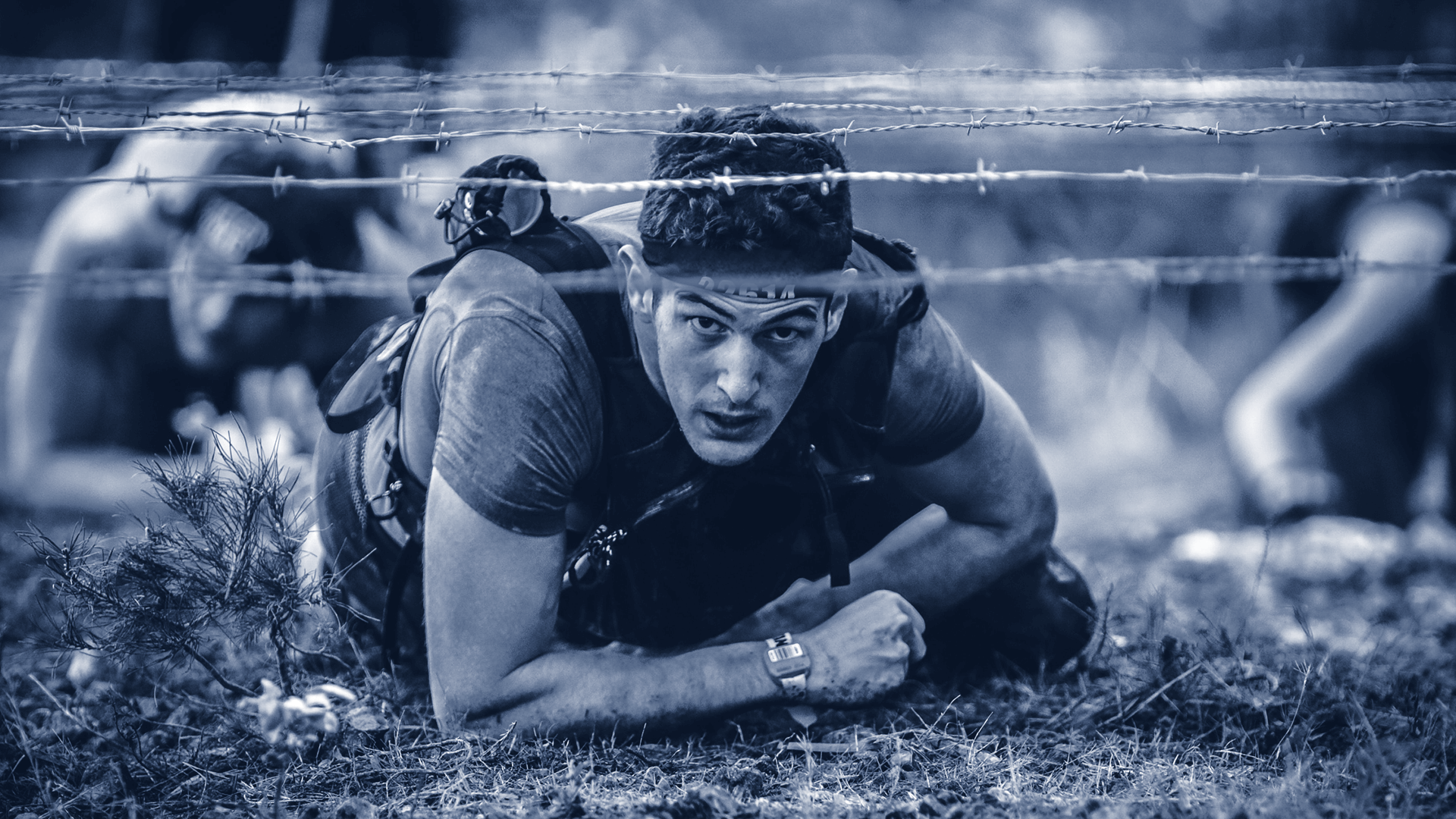

The Most Important Factor for FP&A Success

People, process, and technology are the three pillars of a successful FP&A (Financial Planning and Analysis) team. But, which one is the most important factor in achieving FP&A success? Chris Ortega explains in this video.

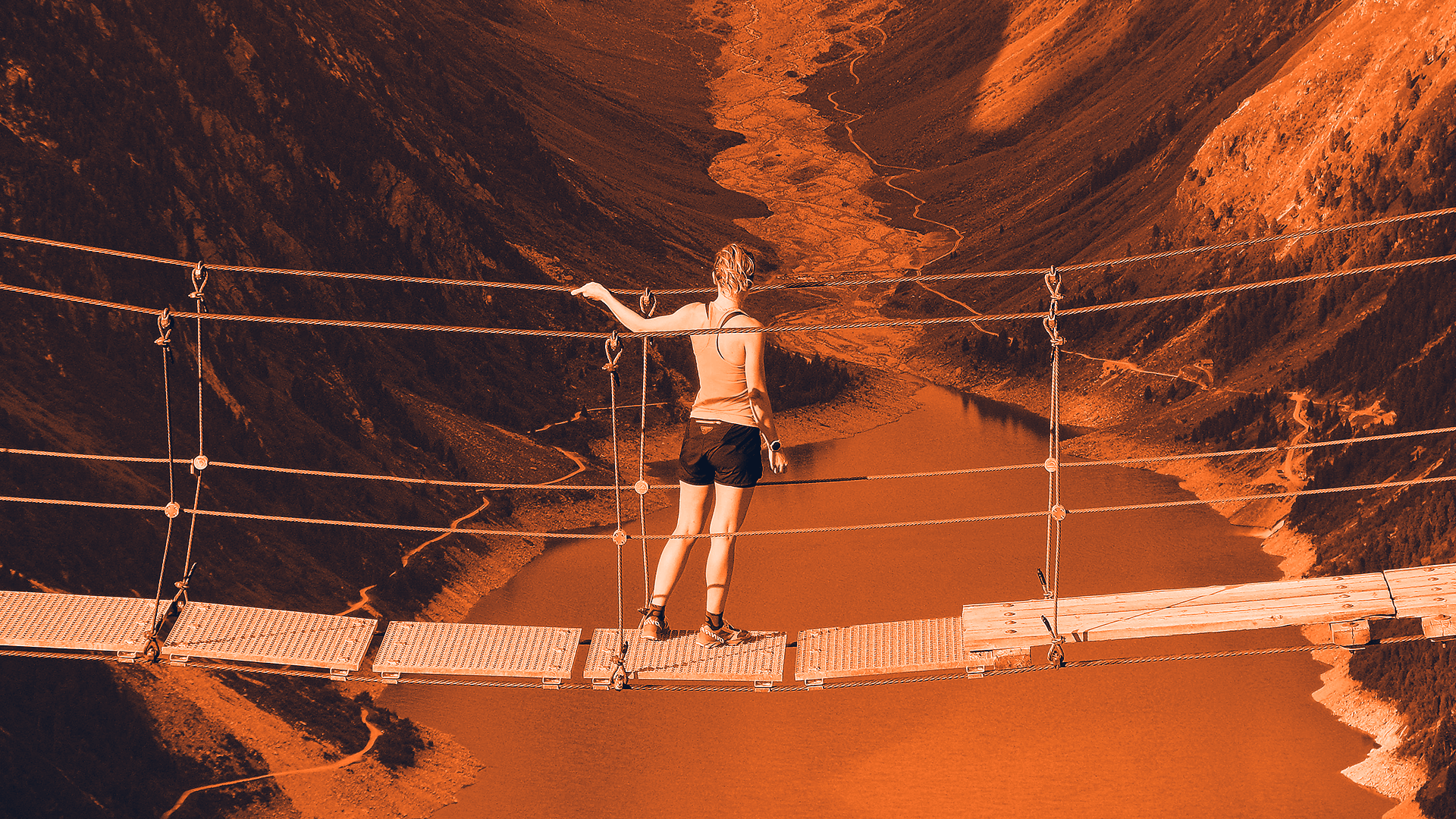

Rolling Forecast vs. Traditional Budget

Which financial forecasting practice is optimal for your organization? Chris Ortega stacks up the traditional budget process against a 12-month rolling forecast to help you decide the best approach to focus on.

We help your organization reach FP&A 2.0 by staying agile and collaborative.