Let’s be real…enterprise-wide change is challenging. Most technology implementations and process development demand some degree of change management in order to succeed. Transitioning to xP&A (Extended Planning and Analysis)—or FP&A 2.0, as we usually call it—is no exception.

Many finance and accounting teams aim to become trusted advisors within their organizations, but they miss the fundamental mindset shift needed to adopt that role. Instead, these teams often maintain an intense focus on driving profit, without considering how partnership and employee experience impact their goals.

“People over profits” isn’t just an HR platitude. When higher employee engagement increases productivity by 18% and profitability by 23%, putting people first starts to look much more appealing to finance leaders.

Becoming a business leader and advisor within your enterprise takes more than digging into the data. It’s critical to empathize with leaders across other business units to understand their goals and ultimately strengthen finance and accounting’s impact and influence on driving business success.

Part of successfully transitioning to FP&A 2.0 (or xP&A, if you prefer) is moving from a directive-driven culture to a culture of empowerment. Because when you prioritize employee engagement, it pays dividends.

Becoming a Cultural Carrier By Empowering Employees

Financial analysts become the arbiters of truth when enterprise data is in their hands. However, explaining what that data means to revenue-creating business units is challenging. xP&A tools and processes reduce gatekeeping without compromising data integrity, so your team collaborates more effectively with other business units while reviewing the same real-time data.

FP&A professionals need to abandon the directive-driven patterns that have so long defined how they work. Directive-driven culture leads finance teams to hold on to manual reporting and data analysis tasks, solidifying their role as the scorekeeper and reducing opportunities for meaningful advisory work.

Becoming an advisor involves creating a cultural shift toward employee empowerment, both within finance teams and across the enterprise. Evolving from scorekeepers to trusted advisors involves three major mindset shifts:

- Deeply empathizing with employee goals and objectives across the enterprise.

- Creating partnerships that empower business units to make rapid revenue-driving decisions.

- Empowering teams enterprise-wide to use data effectively and independently.

xP&A gives finance teams a unique opportunity to create a culture of empowerment by simplifying collaboration, fostering partnership, and empowering teams across the enterprise with the data they need to make impactful decisions.

Putting People Before Profit Drives Business Success

Deeply understanding the risks and opportunities within each business unit involves working closely with people, something FP&A professionals can’t do when they’re heavily focused on reporting or cost-cutting.

Empathetic listening presents a unique opportunity to see the needs of the business in a new light, which makes resource reallocation a discussion rather than a demand. When finance professionals are more concerned about empowering teams to do their best work and use their expertise to drive business success, there’s a higher likelihood that revenue and profit will increase.

This kind of cooperative communication empowers finance professionals to better understand what KPIs to track and see which shifts drive value for the business, rather than simply driving profit. Ultimately, revenue-driving decisions depend on the information and resources available to FP&A professionals.

By expanding the availability of the data used to make those decisions, finance makes it easier for teams across the enterprise to move forward with new initiatives that support overall strategic goals. By promoting self-sufficiency, finance’s role shifts into a more advisory capacity.

How xP&A Simplifies and Strengthens Collaboration

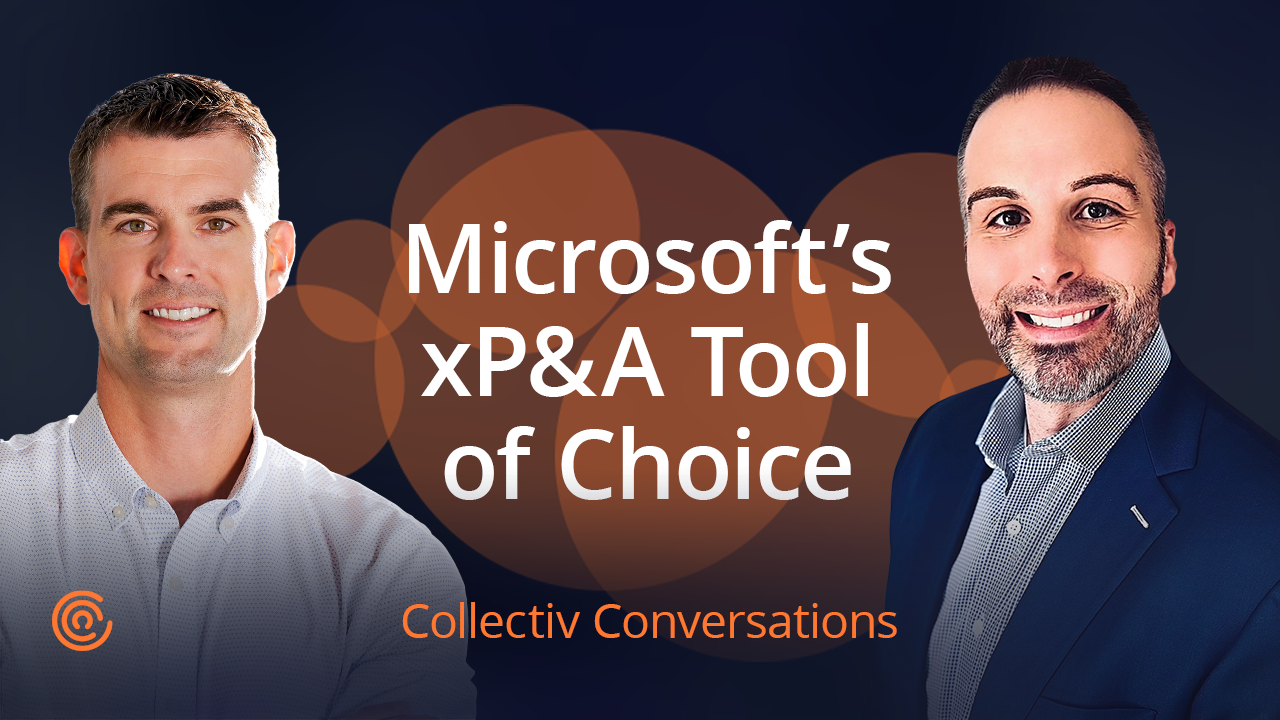

Remote work is here to stay, and teams need the right resources to make decisions quickly outside the office. Shifting to an enterprise-wide business intelligence tool like Power BI simplifies collaborating and communication within finance teams and other business units.

For FP&A professionals, new processes and automation cut down time spent on manual tasks, increasing efficiency and offering more opportunities for advising activities. Creating integrated processes and standards for reporting can dramatically simplify planning and analysis work as well.

Using the right tools is a critical part of improving the employee experience with xP&A. Maintaining a single source of truth offers better visibility across different business units, eroding complexity gaps. Reducing complexity gaps by establishing partnerships creates a more collaborative environment, ultimately improving the employee experience.

Plus, built-in collaboration and sharing tools ensure smoother meetings and get different business units on the same page while reviewing financial reports. When finance teams spend less time explaining what reports mean, they are able to spend more time working with other business units to create new strategies and choose new tactics to drive revenue.

Ready to Create a Culture of Empowerment?

Exceptional culture is an enterprise-wide responsibility. Better visibility, transparency, and collaboration are essential to shift FP&A professionals into trusted advisors. It’s time for FP&A 2.0.

When everyone works off a single source of truth, finance teams spend their time more efficiently and provide more tangible value toward helping the enterprise achieve its operational goals. The employee experience can only go up from here.

Expanding your FP&A capabilities takes a dedicated vision and a roadmap for success. Our FP&A Visioning Program helps you create a better employee experience that pays for itself. Get started today and empower your entire enterprise to make stronger financial decisions.